YOUR GENEROSITY MAKES ALL THE DIFFERENCE

Thank you for your generosity and investment in future generations. Your support makes it possible for students to access higher education, regardless of their financial means so they can pursue their dreams and ambitions.

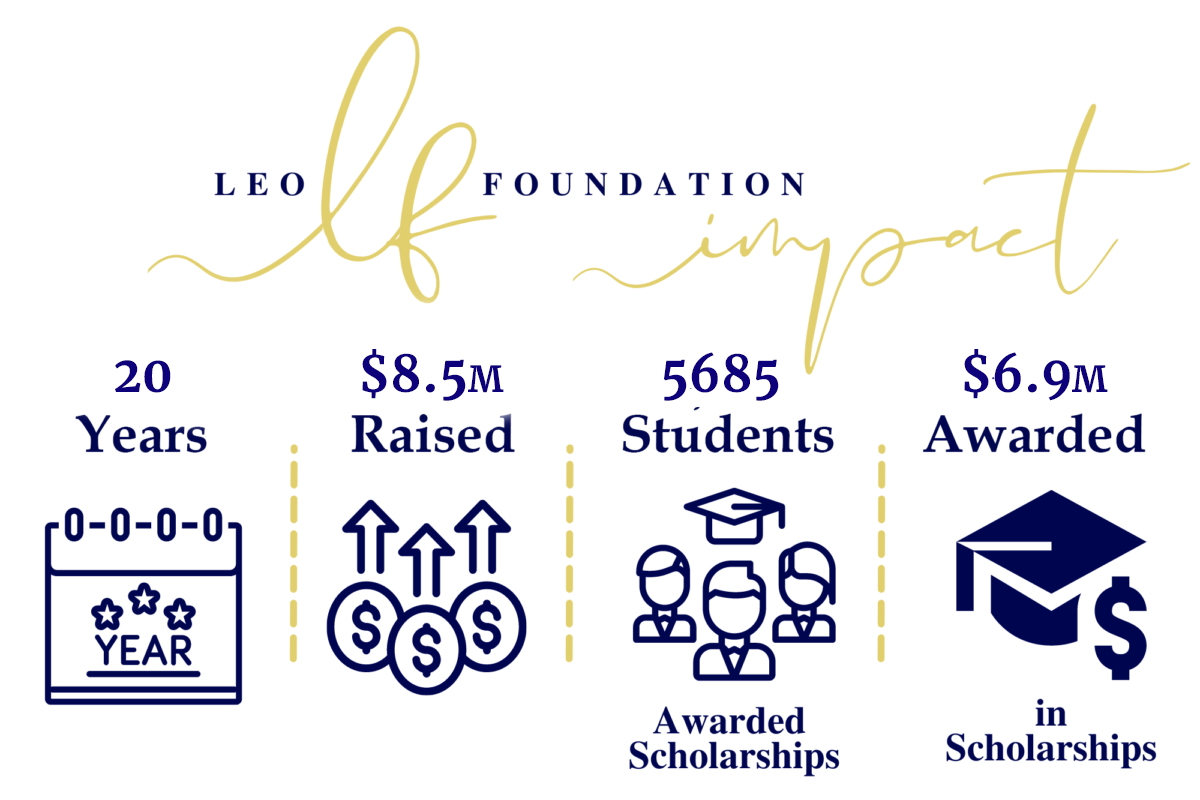

Whether it is your first, second or third gift this year, your annual fund contribution will make a significant impact in helping ensure all students who are accepted through LEO Foundation are able to attend school.

Whether it is your first, second or third gift this year, your annual fund contribution will make a significant impact in helping ensure all students who are accepted through LEO Foundation are able to attend school.

If you wish to support this scholarship, please make your check payable to:

LEO Foundation and write in the memo line, the name of scholarship you are funding.

A charitable trust is a great way to continue making an impact with charitable giving even after you are long gone. A charitable trust can also have many tax incentives and financial benefits for those who want to set aside any assets that are not needed for retirement.

A charitable trust is a great way to continue making an impact with charitable giving even after you are long gone. A charitable trust can also have many tax incentives and financial benefits for those who want to set aside any assets that are not needed for retirement.

You may designate the placement of your gift and choose to donate to a program that is important to you or the gift’s namesake. You may even want to create a scholarship in someone’s name. It may be a one-time scholarship or one you and others can continually contribute.

You may also select unrestricted which allows for funding to be applied where needed.

Imagine making a contribution that leaves a legacy for generations to come. This lasting impact can easily be made by establishing a LEO Foundation endowment.

Endowed funds differ from others in that the total amount of the gift is invested. Only a portion of the income earned is spent each year, while the remainder is added to the principal for growth. In this respect, an endowment is a perpetual gift. LEO Foundation endowments begin at $25,000, funded fully at its initiation or made as a pledge, payable over up to three years. Donors may contribute any amount to an existing endowed program or pool resources with other like-minded individuals or companies to create a new endowment.

You can choose to make a pledge and request that the LEO Foundation reminds you or charges your credit card at a specific time in the future. Making a pledge gives you the flexibility to distribute your gift throughout the year.

For your convenience, billing arrangements can be made monthly, quarterly or annually. We gladly accept the following forms of payment: cash, check, and credit card.

You can also make a secure online gift or pledge to the LEO Foundation by clicking the donate button below. Full payment of pledged gifts should be made by December 31st of each year.

Learn if your company has a match program!

Real estate is a powerful asset that can be donated as a direct gift. A deed or title can be transferred from you to the LEO Foundation easily and without a large amount of unnecessary paperwork. As the donor, you will be eligible for a real estate donation tax deduction which will be equal to the fair market share of your property and can be carried forward for five years. Additionally, you may avoid Capital Gains Tax, which would be incurred if you were to sell the property instead.

If you are interested in learning more about real estate donations, please contact us. We would love to share more information with you.

Setting up your own scholarship is easy. LEO Foundation will provide assistance and expertise in setting up and awarding scholarship dollars to students.

Scholarship assistance can be designated to provide financial relief in a variety of ways, including fees, tuition, room and board, textbooks, technology, and other essentials. Every dollar of every scholarship is an investment in future leaders that ultimately strengthens our communities and contributes to a cycle of success.